In reality, as we know it where the securities exchange can be pretty much as unusual as a wild wilderness, one specific APE Stock Price stands tall in the midst of the mayhem. Meet Chimp, the versatile competitor that has figured out how to keep up with its steadiness notwithstanding market unpredictability. With financial backers nervous and vulnerability approaching, Primate’s enduring development has grabbed the eye of brokers looking for asylum from fierce times.

Yet, what makes Chimp so unique? How can it figure out how to explore through turbulent business sectors sound? Furthermore, above all, how might you exploit this apparently strong stock? We should jump into these inquiries and find everything to be familiar with Chimp’s noteworthy stock cost development!

What is APE?

Gorilla, short for Alpha Power Undertakings, is a rising star in the securities exchange field. This creative organization works in the environmentally friendly power area, gaining practical experience in creating and executing state of the art advances to tackle perfect and feasible power sources. With a solid spotlight on sun based and wind energy arrangements, Gorilla has situated itself as a central participant in the worldwide shift towards greener other options.

What separates Chimp from its rivals is its steady obligation to innovative work. The organization’s devoted group of researchers and specialists are continually pushing limits, looking for forward leaps that will alter the environmentally friendly power industry. By remaining at the front line of innovative headways, Chimp guarantees it stays one stride in front of the opposition.

Notwithstanding being moderately just now getting some traction, Gorilla has in no time earned respect for its extraordinary monetary exhibition. Financial backers have considered this promising upstart with its noteworthy income development many quarters. As manageability turns into an undeniably fundamental worry across businesses around the world, Gorilla’s ground breaking approach positions it well for long haul achievement.

Notwithstanding their progressive items and administrations, Chimp’s corporate culture underlines straightforwardness and responsibility. They endeavor to construct trust among partners by giving normal reports on undertakings’ advancement while keeping up with thorough guidelines with regards to moral strategic policies.

With this multitude of variables consolidated – development driven arrangements, heavenly monetary outcomes, and a pledge to straightforwardness – it’s no big surprise that financial backers are running towards Primate like honey bees attracted to nectar-loaded blossoms! So we should investigate further the way that this exceptional organization oversees in the midst of tempestuous economic situations.

What is the Market Volatility Index?

The Market Unpredictability File, otherwise called VIX or the trepidation check, is a proportion of market assumptions for future instability. It gives brokers and financial backers experiences into how unsure or stable the securities exchange might be in the close to term. The VIX is determined by examining choices costs on S&P 500 record choices.

A higher VIX demonstrates more noteworthy anticipated instability, while a lower VIX recommends more settled economic situations. It is vital to take note of that the VIX itself can’t be exchanged straightforwardly; it fills in as a greater amount of a pointer for market opinion.

Dealers utilize the VIX to evaluate hazard and come to informed conclusions about their ventures. At the point when there is uplifted vulnerability or dread in the business sectors, financial backers might look for more secure resources like bonds or gold. Then again, when unpredictability dies down, they might feel more open to taking on less secure positions.

Checking and understanding the Market Instability Record can give significant bits of knowledge to exploring unstable monetary business sectors and settling on all around informed exchanging choices.

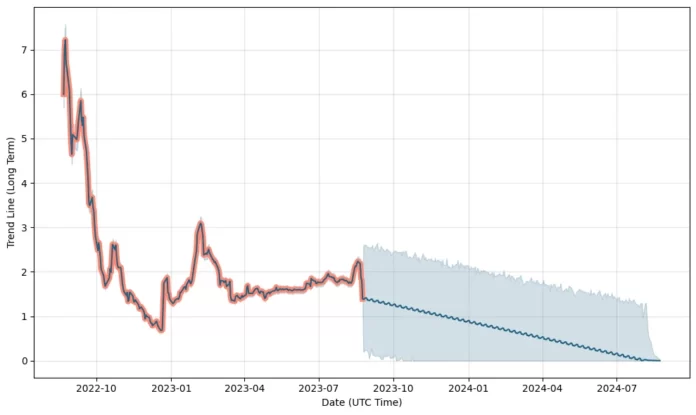

What are the APE Stock Price Movement?

Gorilla APE Stock Price development has been a subject of revenue for financial backers recently. With the market unpredictability record on the ascent, many are interested about how Gorilla is holding up. All things considered, we should jump into it!

It’s essential to comprehend that Primate alludes to the stock cost of an organization called Gorilla Inc. This organization works in the innovation area and has encountered huge development throughout recent years. Similarly as with any public stock, its cost is dependent upon vacillations in view of different variables.

While dissecting Primate’s stock cost development, it becomes apparent that it has shown versatility in the midst of market unpredictability. Notwithstanding periodic plunges and spikes, in general, Gorilla’s stock cost has remained somewhat stable contrasted with others in its industry.

Financial backers have observed this soundness and have acquired trust in putting resources into Primate. The steady presentation of the organization combined with positive market opinion has added to this pattern.

It is worth focusing on that while no speculation can be completely safe to showcase changes, observing patterns and leading exhaustive examination can assist financial backers with settling on informed choices in regards to exchanging Primate stocks.

Notwithstanding continuous market unpredictability, Chimp’s stock cost development has shown strength and security. Financial backers who are keen on exchanging these stocks ought to intently screen patterns and direct their expected level of effort prior to pursuing any speculation choices.

How to Trade APE Stock

Exchanging Gorilla APE Stock Price can be a worthwhile chance for financial backers looking to gain by its flexibility even with market instability. The following are a couple of procedures to consider while exchanging Chimp stock.

Above all else, directing intensive examination and investigation prior to pursuing any venture choices is significant. Remain informed about the most recent news, refreshes, and monetary reports connected with Chimp. This will assist you with acquiring important experiences into the organization’s presentation and pursue more educated exchanging choices.

Another key system is to intently screen the market patterns and variances. Watch out for the general market instability file as well as unambiguous variables that might influence Gorilla stock cost development. By understanding these examples, you can distinguish likely passage or leave focuses for your exchanges.

Furthermore, consider utilizing specialized examination apparatuses and pointers to survey cost developments and recognize expected trading open doors. These apparatuses can give important data about help levels, obstruction levels, pattern lines, and other pivotal elements influencing Gorilla stock cost.

Moreover, put forth clear objectives for your exchanges and lay out risk the board methodologies, for example, stop-misfortune orders to shield your ventures from critical misfortunes. Recall that exchanging implies chances, so it’s fundamental to have a trained methodology that lines up with your gamble resilience level.

Consider expanding your portfolio by including different stocks or resources close by Gorilla stock. This helps spread out speculation gambles while possibly amplifying returns.

By carrying out these techniques inside your exchanging plan while remaining refreshed on economic situations encompassing Primate stock explicitly – you’ll be better situated to effectively explore its exceptional attributes!

Conclusion

The Chimp APE Stock Price has shown astounding flexibility even with market unpredictability. In spite of variances in the more extensive market and vulnerability encompassing monetary circumstances, Chimp has figured out how to keep up with its soundness. This can be credited to a few factors, for example, powerful monetary execution, solid supervisory group, and a broadened portfolio.

Financial backers hoping to exchange Chimp stock ought to painstakingly dissect market drifts and talk with monetary counselors prior to settling on any choices. It is vital to think about both momentary vacillations and long haul potential while assessing venture amazing open doors.

While no speculation comes without chances, Primate gives off an impression of being a promising choice for those looking for soundness in the midst of questionable times. By remaining informed about market advancements and embracing reasonable exchanging procedures, financial backers might possibly profit from the versatility of Primate’s stock cost.

Recollect that contributing implies inborn dangers and it means a lot to lead intensive exploration prior to committing your assets. Watch out for organization news discharges, industry patterns, and by and large market opinion to settle on very much educated choices.

In spite of market unpredictability being a typical event in the present unique climate, the Gorilla stock cost has substantiated itself tough consistently. With cautious investigation and key decision-production by financial backers, there could be huge open doors for development inside this steady speculation choice. So why not investigate the conceivable outcomes that lie ahead? Cheerful exchanging!